|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

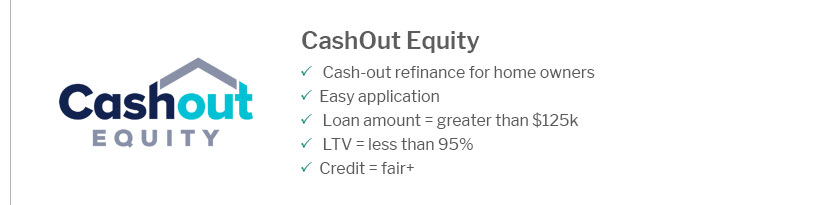

Exploring the Best Equity Loan Banks: A Comprehensive GuideUnderstanding Equity LoansEquity loans, often referred to as home equity loans, are a popular financial product for homeowners looking to leverage the equity built up in their properties. These loans can provide substantial funds for various needs such as home renovations, debt consolidation, or other large expenses. How Equity Loans WorkEquity loans allow homeowners to borrow against the value of their home. The loan amount is typically determined by the difference between the home's current market value and the outstanding mortgage balance. Top Banks Offering Equity LoansWhen searching for the best equity loan banks, it's crucial to compare interest rates, loan terms, and customer service. Here are some top contenders:

Factors to Consider When Choosing a BankInterest RatesInterest rates can vary significantly between lenders. It's important to shop around and compare rates to ensure you're getting the best deal. Consider both fixed and variable rate options. Loan TermsLook for banks that offer favorable terms, including reasonable repayment periods and minimal fees. Longer terms may result in lower monthly payments but can lead to paying more in interest over time. For those considering other financing options, exploring 0 down payment home loans might also be beneficial. Customer ServiceGood customer service can make the loan process smoother and less stressful. Look for banks with positive reviews and responsive customer service teams. Frequently Asked Questions

Understanding your equity and the options available can help you make informed decisions about your financial future. For those considering refinancing, learning about condo refinance owner occupancy may provide additional insights. https://www.oldnational.com/personal/home-loans/home-equity/

What's the Best Way To Tap Your Home Equity? Unsure what's right for you? Learn the differences between a HELOC, home loan, and a cash-out mortgage refinance. https://www.reddit.com/r/personalfinance/comments/1f3sfrz/home_equity_loansheloc_suggestions_for_best_bank/

I have been calling around for a home equity loan or a HELOC and am finding wildly different loan amounts and rates. I've seen as low as 8.5% and as high as 11 ... https://www.youtube.com/watch?v=qzDJu-0rAWc

What Bank Has The Best Home Equity Loan? If you're looking to tap into your home's equity for funding projects or managing debt, ...

|

|---|